How UK property fell out of touch with the public in 2020

How UK property fell out of touch with the public in 2020

New research shows how the UK property industry struggled to adapt and keep up with new trends and conversations. The built environment needs a new narrative to sustain asset values.

UK property’s communications gap

The UK property sector is less in touch with the public than before the pandemic, according to ING’s latest study.

The UK property’s communications gap tracked public conversations across online news and social media and compared these with the conversations from 65 top UK property companies, mostly developers and asset managers, before and during COVID-19. It found that:

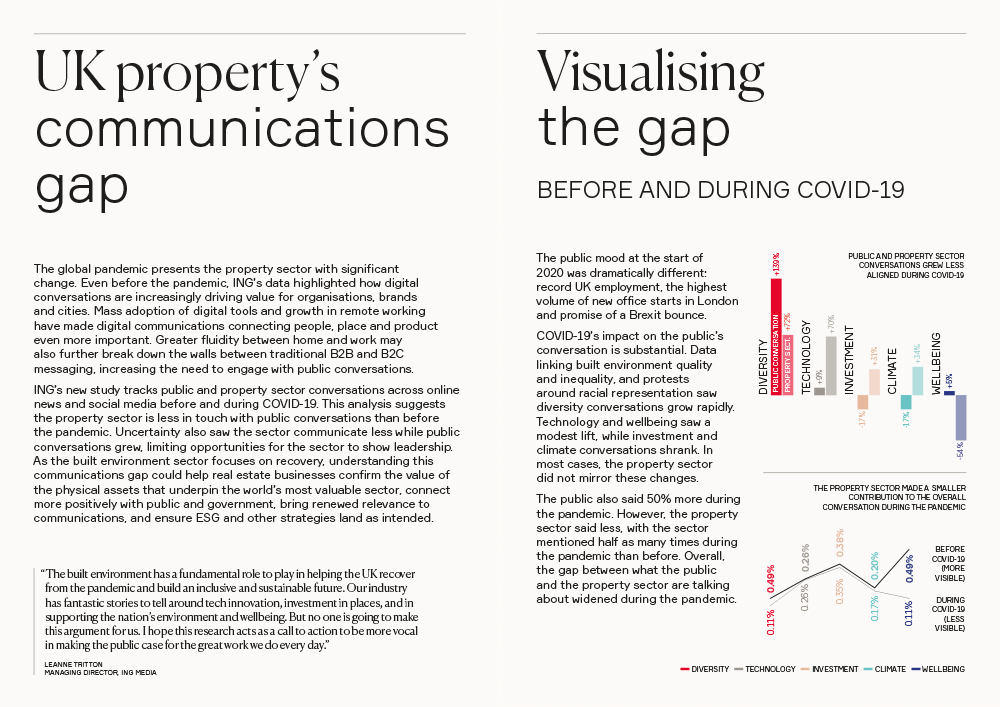

The property industry shrunk into its shell, communicating half as much as pre-pandemic levels whilst online public conversations grew by 50%

When the property industry did speak, it was less aligned on public conversations around certain subjects: it did speak more often about diversity but not nearly as much as the increase in public conversations

Meanwhile it increased how much it spoke about investment and climate change as these topics shrunk in the public discourse. It also spoke significantly less about wellbeing as the public conversation grew.

“Now is not the time to shrink into our shells. The built environment has a fundamental role to play in helping the UK to successfully recover from the pandemic, yet only a relative few in our sector are stating this convincingly. It is the responsibility of everyone in property to be active, visible citizens, explaining how we can build an inclusive and sustainable future.”

UK property’s communication gap

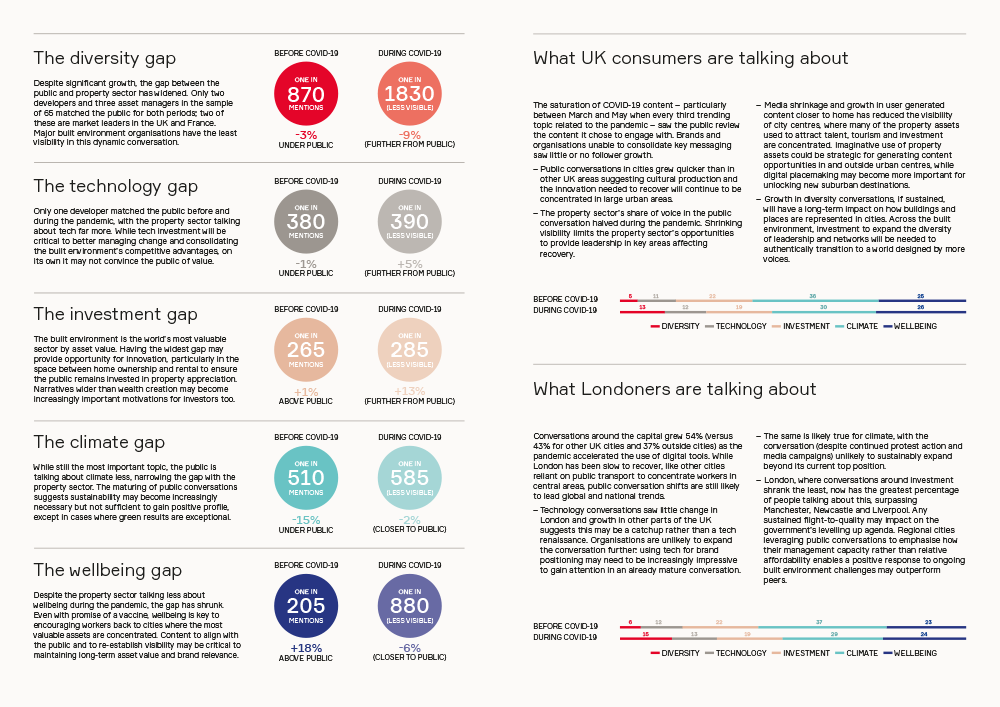

The Diversity Gap

Despite significant growth in diversity as a topic this year (139% increase in public conversations as measured by online news and social media mentions) only two developers and three asset managers kept up with the public. A quarter of developers did not contribute to the diversity conversation before or during the pandemic.

The Technology Gap

Property talked significantly more about technology than the public during the pandemic with a 70% increase from pre-pandemic levels compared to just 9% by the public. This was powered by conversations around remote working and the future of the office and homeworking.

The investment gap

The property sector spoke about investment significantly more (32%) than the public (-17%). Having the the widest gap may provide opportunity for innovation for a sector where most of the world’s asset value is concentrated.

The Climate Change Gap

The public talked about climate change less during the pandemic (-17%), but the property sector led the way, increasing how much it focused on climate change as a topic by (43%).

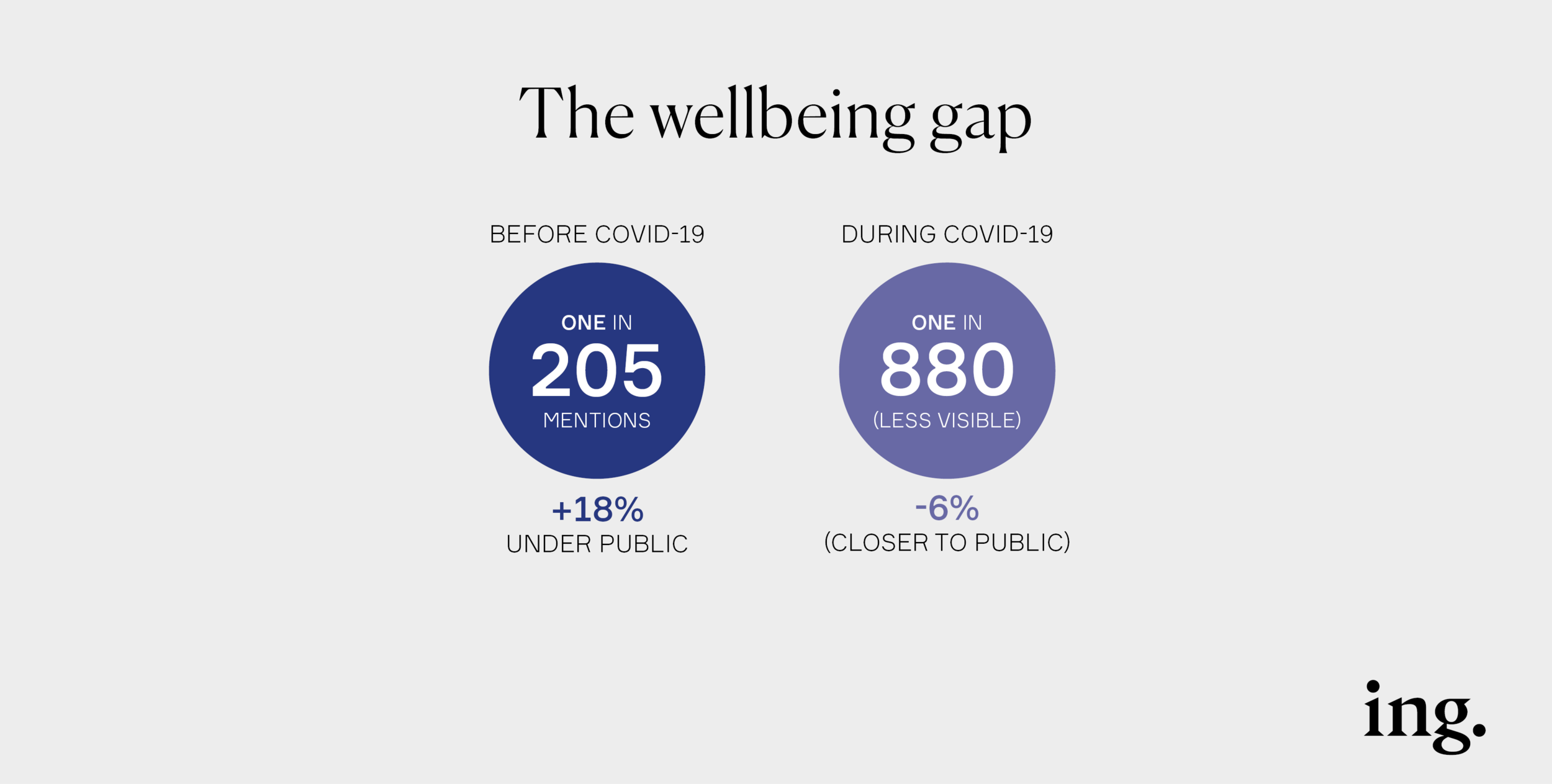

The Wellbeing Gap

For wellbeing there was the reverse effect to climate change. Unsurprisingly, the public talked more about health and wellbeing during the pandemic (5% increase) but the property sector dramatically stopped talking about the subject, with a 54% reduction in online news and social media mentions. The need for better and healthier buildings for living, working, and playing in suggests developers may be missing opportunities to engage with a public eager for higher quality built environments.

“Our industry has a fantastic story to tell around technological innovation, investment in places, and in supporting the nation’s environment and wellbeing. But no one is going to make this argument for us. I hope this research acts as a call to action that we all can and must be more vocal in making the public case for the great work we do every day.”

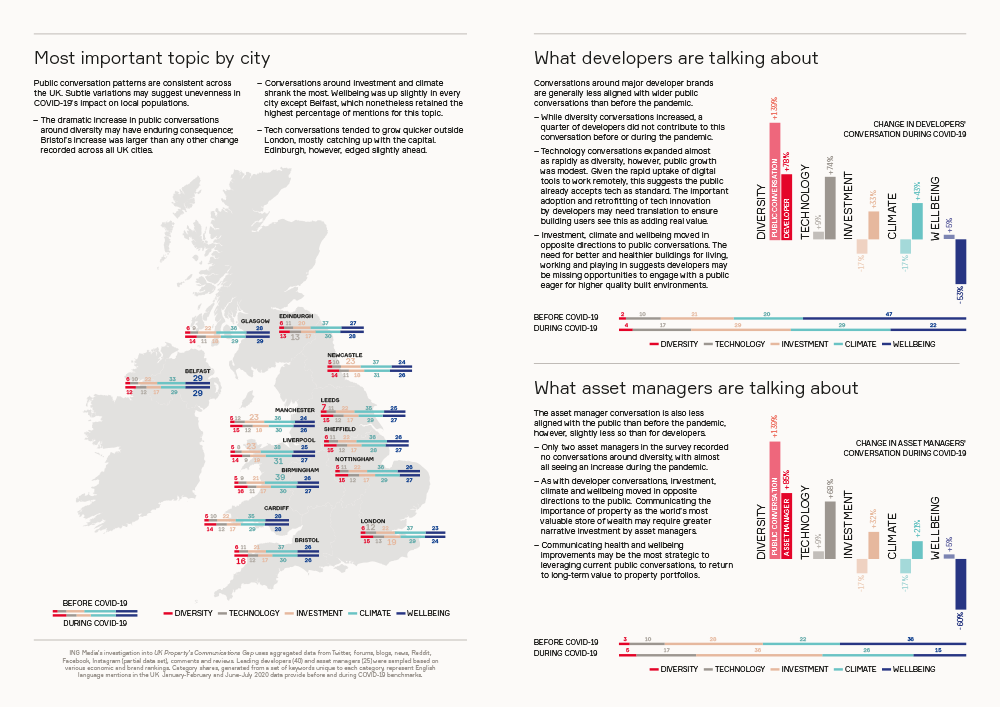

What UK cities are talking about

Public conversation patterns are consistent across the UK, but grew quicker in cities than in other UK areas suggesting cultural production and the innovation needed to recover will continue to be concentrated in large urban areas. Subtle variations may suggest unevenness in COVID-19’s impact on local populations.

Bristol’s increase in conversations around diversity was larger than any other change recorded across all UK cities.

Conversations around investment and climate shrank the most. London, where conversations around investment shrank the least, now has the greatest percentage of people talking about this, surpassing Manchester, Newcastle and Liverpool. This may impact on the levelling up agenda.

Technology conversations tended to grow quicker outside London, mostly catching up with the capital. Edinburgh, however, edged slightly ahead.

Wellbeing was up slightly in every city except Belfast, which nonetheless retained the highest percentage of mentions for this topic.

Produced by ING Media, this research is part of a global exploration into how online news and social media impacts on cities, brands and organisations. If you would like to learn more about how ING works with the built environment or for detail on how your organisation performs email: info@ing-media.com

ING Media’s investigation into UK Property’s Communications Gap uses aggregated data from Twitter, forums, blogs, news, Reddit, Facebook, Instagram (partial data set), comments and reviews. Leading developers (40) and asset managers (25) were sampled based on various economic and brand rankings. Category shares, generated from a set of keywords unique to each category, represent English language mentions in the UK. January-February and June-July 2020 data provide before and during COVID-19 benchmarks. Cities surveyed include: Belfast, Birmingham, Bristol, Cardiff, Edinburgh, Glasgow, Leeds, Liverpool, London, Manchester, Newcastle, Nottingham, Sheffield.